Changes to Form 5500 Will Allow a Greater Number of Small Plans to Avoid the Annual Audit Requirement

From time to time the Department of Labor, the Internal Revenue Service and/or the Pension Benefit Guaranty Corporation make revisions to Form 5500.

Revisions made to the 2023 Form 5500 relate to SECURE Act amendments made to ERISA. The changes are intended to improve reporting of financial information and plan expenses. There are new compliance questions concerning safe harbor status and how a plan satisfied certain discrimination and coverage tests.

A significant change affects the methodology for determining if a plan has less than 100 participants and is, therefore, treated as a small plan exempt from the annual requirement to retain an independent auditor. Under the current rule, all eligible individuals must be counted, even those who elect not to participate. Going forward only participants and beneficiaries with account balances on the first day of the plan year must be counted.

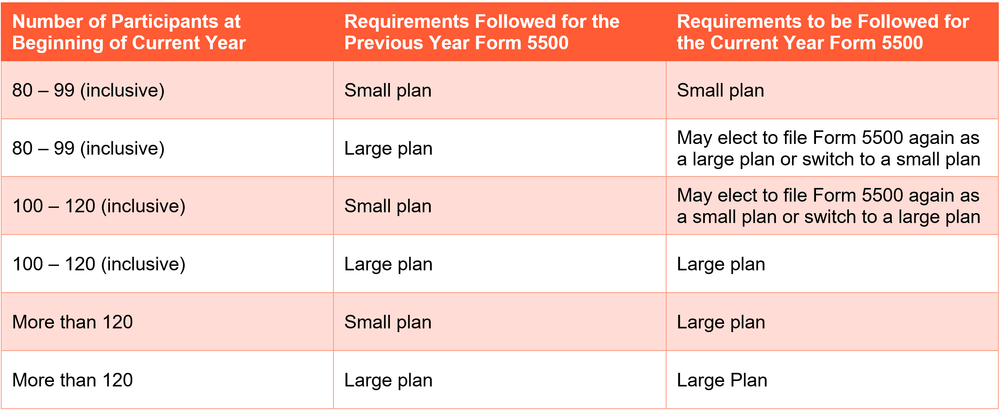

There is a rule known as the 80/120 rule intended to prevent plans with close to 100 participants from regularly falling within and without the scope of a required audit. Under this rule, a plan treated as a small plan in the previous year will continue to be exempt from the audit requirement if has less than 120 participants. This rule works as follows:

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. The material presented was created by RPAG. Securities, investment advisory, and financial planning services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC (www.sipc.com). Supervisory Office: 16 Campus Blvd, Newtown Square, PA 19073. Cadence Financial Management, LLC is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. ACR# 5802689 07/23