Market Update

There once was a man out of options. He was broke and desperate. While little is known of what got him into this situation, much is known about what he did next.

After much thought, he hatched a plan to solve his financial trouble….a plan based on a remarkably creative theory of invisibility.

On a crisp spring day, he woke up and put his plan into action:

Step 1. Wake up.

Step 2. Apply lemon juice to face.

Step 3. Take a selfie with his Polaroid camera.

Step 4. Check Polaroid photo to confirm that lemon juice indeed creates invisibility.

Step 5. Rob a bank in broad daylight. Stare directly into the bank’s security camera because, after all, the camera couldn’t see him.

Step 6. Rob a second bank in broad daylight. Stare at the security camera again because, well, you get the idea…

Step 7. Celebrate his genius plan. Pay off debts.

Now, as you might imagine, the man was feeling pretty smug while exiting the second bank. For some remarkable reason, he was the only person in the history of mankind to figure out that lemon juice made humans invisible. Remember those elementary school experiments of writing on paper with lemon juice, applying a small bit of heat, and watching the message suddenly appear? Voila!

This fellow had been the only one to make the jump that applying lemon juice to a human face would also somehow prevent a camera from reading said face, and oh, ho, ho, what a future he could create!

What genius! What insight! What logic and reason! And, while being careful not to count said chickens before said hatching…he began to imagine his suddenly bright future.

Unfortunately, the police didn’t agree. After our protagonist walked out of the bank, the police walked in, pulled the tapes, identified the man, and arrested him. Of course, there was little debate as to who actually robbed the banks because, well, his face was all over the security tapes.

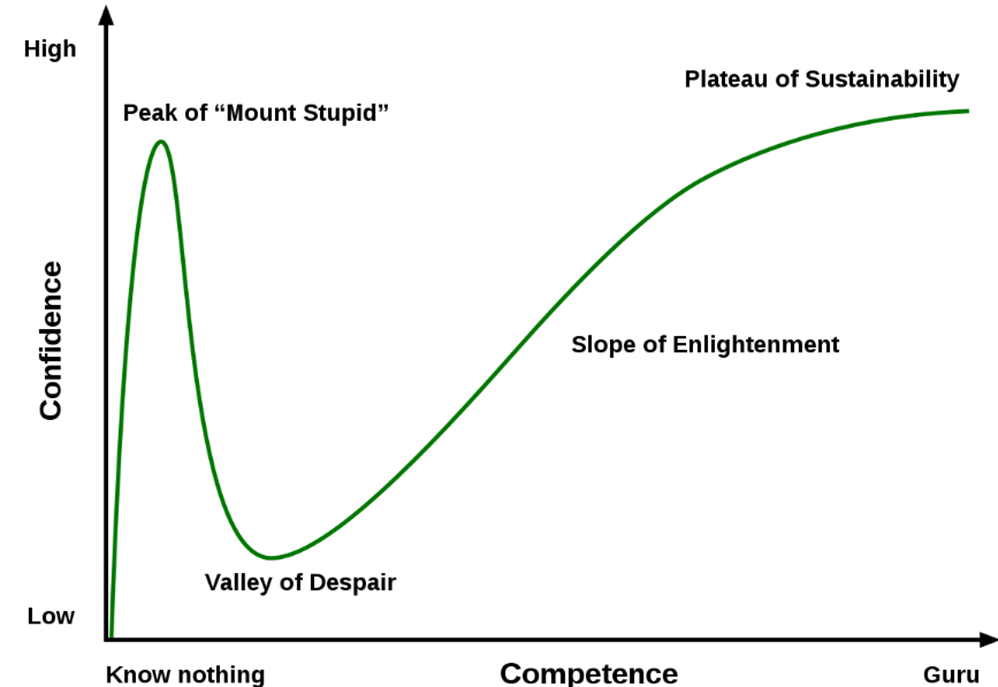

This fascinating moment of human overconfidence and confirmation bias happened in Pittsburgh in 1995, and we have a man named McArthur Wheeler to thank. Two social psychologists researched the story and famously formalized it as the Dunning Kruger effect, which is essentially a projection of how humans tend to overestimate their abilities at low levels of knowledge. The chart below demonstrates the relationship between competence and confidence.

So, my dear readers might ask, what does the Dunning Kruger effect have to do with markets?

I was reminded of this story recently when talking with a close friend who is, shall we say, down on the world right now. As I probed his unhappiness and frustration further, I heard echoes of Chinese economic and military dominance, frustration with monetary policy, a vague reference to the hallowed “neutral rate,” and a general sense that humans are doomed.

We hear this frequently from partners and clients of all walks of life and political leanings. As we have written about at length, it is helpful to remember that our brains are hard-wired to engage with and respond to “bad news” and, as such, we are inundated with “bad news” frequently in order to gain our attention.

Somewhat unfortunately, we are also in a moment where, due to the current government shutdown, most of the data we have come to love and relish is also not being released. Hmmm…”so what’s he going to do for us, Marge, show us his finger paintings?”

With a nod to our (unfortunately not) invisible protagonist, and while ignoring the paucity of market data available…for this market update, I offer a slightly different perspective. Sometimes the best thing we can do is 1) zoom out, and 2) have others show us that perhaps the view we hold may not be perfectly accurate.

With that, let us begin…

To be a possibilist…

Swedish physician and academic Hans Rosling once wrote, “Everyone is entitled to their own opinions, but not to their own facts.”

You see, contrary to popular opinion, and certainly contrary to the news we hear every day, the world has made, and continues to make, remarkable progress. And I say this not from an economic growth or profitability perspective but from, quite simply, the human perspective. After all, growth in and of itself is not “good” or “bad”—unless it is associated with an improvement in the collective human experience. Growth, for example, if done well, can lift people out of poverty and improve lives.

Which brings us to the first demonstration of that idea, the life expectancy of United States citizens.

The above chart shows the life expectancy of the population of the United States going back to 1876. Then, the life expectancy of an American was around 39…fast forward, and today it is more than double at 80. Life expectancy, in many ways, is the perfect integrator of human welfare—because it combines advances in nutrition, medicine, education, and, yes, peace. And while the United States is just one country, it certainly shows a story of remarkable improvement. Perhaps even more fascinating is that in just the past 20 years that line is five years lower...in just two decades we have increased our life expectancy, on average, by five years.

Ahh, yes, you say but perhaps the wealthy are simply pushing that line higher with better medicine, better access, better nutrition, and the like. After all, this is the wealthiest country in history. How about the less fortunate? Well, that brings us to Chart 2.

Chart 2 takes 194 countries for which I have data and averages the percentage of people living on less than $3 per day (and yes, the data is inflation adjusted)(3).

So, just 25 short years ago, nearly 20% of the global population was living in extreme poverty and, today, that number is closer to 3%. In 1980, just 45 short years ago, that number was nearly 40%. Said another way, if you are older than 25, you have just lived through the most rapid improvement in living standards in recorded history. Perhaps more stunningly, for Americans, it happened fairly quietly in areas like China, India, and sub-Saharan Africa.

Alright, you say, now we’re talking. But how about the kids?! Thank you for asking.

Which brings us to Chart 3.

Let’s be clear on this chart. In the year 1800 (far left of chart), for every 1,000 live births, the chart shows the number of expected deaths from birth to age five. To make this clearer and, with my apologies, more morose, in the year 1800, roughly 422 children were expected to die between birth and their fifth birthday. Today, that number is 23 out of 1,000.

Think of the magnitude! This literally means that, every day, tens of thousands of children who would have died in 1960, for example, are now living healthy, productive lives. For those interested in history, the massive change in the slope in the early 1900s was from humanity figuring out that sanitation actually mattered. From there, the slope accelerated further with the development (and expansion) of antibiotics in the 1940s.

Ladies and gentlemen, we are living in the safest, healthiest, and most prosperous time in the entire history of mankind. We are living longer, have fewer health issues, less risk of dying, more equality, and generally far more wealth and resources than previously imaginable.

Are there challenges? Yes. Do we occasionally make poor decisions and poor policies? Absolutely. Is everyone similarly benefiting from this era? Certainly not.

And yet what remains true is that, unequivocally, humanity is improving upon many different measures and, occasionally, despite so much negativity, bipartisan politics, conflict, and tragedy…it might be useful to remind ourselves to take a breath, take a step back, and appreciate the remarkable trajectory we are on.

We remain at your service and watching closely.

Authored by:

Daken J. Vanderburg, CFA

Chief Investment Officer

MassMutual Wealth Management

Sources:

(1) Source: World Population Prospects, United Nations, gapminder/data, through Oct. 15, 2025

(2) Source: data.worldbank.com, gapminder/data, through Oct. 15, 2025

(3) Note for those data hawks, I took a simple average of all countries I had data for. One could argue they should be population weighted, or GDP-weighted…which I did as well, and the outcome was largely the same.

(4) Source: data.worldbank.com, gapminder/data, through Oct. 15, 2025

Asset allocation does not guarantee a profit or protect against loss in declining markets. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio or that diversification among asset classes will reduce risk.

This material does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual. The opinions expressed herein are those of Daken J. Vanderburg, CFA as of the date of writing and are subject to change. MassMutual Trust Company, FSB (MassMutual Trust) and MML Investors Services provide this article for informational purposes, and does not make any representations as to the accuracy or effectiveness of its content or recommendations. Mr. Vanderburg is an employee of MassMutual Trust and MML Investors Services, and any comments, opinions or facts listed are those of Mr. Vanderburg. MassMutual Trust and MML Investors Services, LLC (MMLIS) are subsidiaries of Massachusetts Mutual Life Insurance Company (MassMutual).

This commentary is brought to you courtesy of MassMutual Trust and MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Material discussed is meant for informational purposes only and it is not to be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should be relied upon when coordinated with individual professional advice. Clients must rely upon his or her own financial professional before making decisions with respect to these matters. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

MassMutual Wealth Management is a business line of MassMutual. Securities, investment advisory, and wealth management services offered through MML Investors Services, LLC member SIPC, and a MassMutual subsidiary. 1295 State Street, Springfield, MA 01111-0001

Cadence Financial Management is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies.

©2025 Massachusetts Mutual Life Insurance Company, Springfield, MA 01111-0001 All Rights Reserved. www.massmutual.com

MM202810-314038